Latest News

BUSINESS QUARTERLY – New housing projects could provide relief

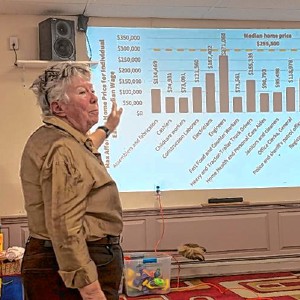

Around the Monadnock Region, a number of new developments, some under construction and some still in the planning stages, could slowly bringing relief to the region’s housing shortage. In Peterborough, as of mid-April, the Peterborough Planning Board...

Mountain Shadows School hosts Olympic Studies Night

According to Temple Brighton, one of the co-founders of Mountain Shadows School, the school’s Olympic Studies Night was inspired by the 1984 Summer Olympics in Los Angeles. “There was so much energy around those Olympics, and all this excitement, and...

Sports

Katalina Davis dazzles in Mascenic shutout win

The Mascenic softball team soared to a 7-0 shutout win over regional and interdivisional rival Conant thanks to a dazzling performance on both sides of the ball from senior pitcher Katalina Davis. “When Kat’s on, they’re not hitting, so she was...

LOCAL SPORTS ROUNDUP: Conant girls’ tennis gets first win

LOCAL SPORTS ROUNDUP: Conant girls’ tennis gets first win

Conant girls’ tennis continues to seek improvement

Conant girls’ tennis continues to seek improvement

Jack Kidd and Kidd Gloves make donation to Mt. Monadnock Little League

Jack Kidd and Kidd Gloves make donation to Mt. Monadnock Little League

Opinion

Viewpoint: State Rep. Molly Howard – Public schools are the bedrock of communities

A recent Google search informed me that New Hampshire students rank sixth in the nation, according to U.S. News and World Report, with similar results on other sites.That’s pretty good, considering New Hampshire ranks 50th in public school funding,...

Business

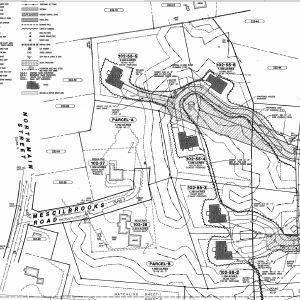

Peterborough Planning Board approves 14-unit development near High Street

The Peterborough Planning Board voted 4-2 Monday to approve Ivy Vann’s and Hugh Beyer’s application for construction of a 14-unit development off High Street after a public hearing.The hearing on the subdivision application followed a site walk of the...

Deb Caplan builds a business out of her creative passion

Deb Caplan builds a business out of her creative passion

Parker and Sons Coffee Roasting in Peterborough strives to create the perfect coffee

Parker and Sons Coffee Roasting in Peterborough strives to create the perfect coffee

Arts & Life

Yoko Ono to receive MacDowell Medal

Artist and activist Yoko Ono is this year’s recipient of the Edward MacDowell Medal. Ono, whose career as an artist began in the downtown New York scene in the early 1960s and has continued across seven decades, has developed a body of work...

Gnome Notes: Emerson Sistare – Amor Towles weaves tapestry in ‘Table for Two: Fictions’

Gnome Notes: Emerson Sistare – Amor Towles weaves tapestry in ‘Table for Two: Fictions’

Jaffrey Civic Center hosting Heart of the Arts

Jaffrey Civic Center hosting Heart of the Arts

Project Shakespeare to present ‘The Miraculous Journey of Edward Tulane’

Project Shakespeare to present ‘The Miraculous Journey of Edward Tulane’

The Thing in the Spring returns May 16

The Thing in the Spring returns May 16

Obituaries

Kevvin W. Sawtelle 31

Kevvin W. Sawtelle 31

Kevvin W. Sawtelle, 31 Jaffrey, NH - Kevvin W. Sawtelle, 31, of Rindge, died peacefully on April 5, 2024, in the arms of his family at the Dartmouth-Hitchcock Medical Center in Lebanon, NH after a long battle with brain cancer. Kevvin w... remainder of obit for Kevvin W. Sawtelle 31

Constance Boldini

Constance Boldini

Westmoreland, NH - Constance Marie (Wilson) Boldini, died April 16, 2024. She is predeceased by her husband Guido Boldini and her son Peter Vaillancourt. She is survived by two daughters, Anne Young of Tennessee, Brenda Bryer of Stoddar... remainder of obit for Constance Boldini

Beverly R. Gienty

Beverly R. Gienty

Peterborough, NH - Beverly R. Gienty, 88, of Windsor, CT, formerly of Peterborough, Dublin, Francestown, and Jaffery NH passed away on April 14, 2024, at Kimberly Hall South, Windsor, CT. She was the widow of Edward H. Gienty. Beverly w... remainder of obit for Beverly R. Gienty

David Albin Shaw

David Albin Shaw

Peterborough NH - David A. Shaw, age 85, of Peterborough died April 7, 2024 after a long co-existence with Alzheimer's disease. He will be missed by his family, friends and devoted caregivers. His care and their love in the Memory Suppo... remainder of obit for David Albin Shaw

BUSINESS QUARTERLY: Grants allow towns to study housing

BUSINESS QUARTERLY: Grants allow towns to study housing

BUSINESS QUARTERLY: Dan Petrone – A guide to the commission settlement

BUSINESS QUARTERLY: Dan Petrone – A guide to the commission settlement

BUSINESS QUARTERLY – Antrim Planning Board approves Battaglia subdivision

BUSINESS QUARTERLY – Antrim Planning Board approves Battaglia subdivision

Molly Howard and Donovan Fenton talk issues at Hancock Town Library

Molly Howard and Donovan Fenton talk issues at Hancock Town Library

HOUSE AND HOME: The Old Parsonage in Antrim is a ‘happy house’

HOUSE AND HOME: The Old Parsonage in Antrim is a ‘happy house’ Former home of The Folkway in Peterborough is on the market

Former home of The Folkway in Peterborough is on the market Two Jaffrey-Rindge Destination Imagination teams move on to Globals

Two Jaffrey-Rindge Destination Imagination teams move on to Globals Old Homestead Farm in New Ipswich requests variance for short-term rental cabins

Old Homestead Farm in New Ipswich requests variance for short-term rental cabins

HIGH SCHOOL SPORTS ROUNDUP: Tasha MacNeil leads the way for ConVal at Pelham Invita

HIGH SCHOOL SPORTS ROUNDUP: Tasha MacNeil leads the way for ConVal at Pelham Invita Parker and Sons Coffee Roasting in Peterborough strives to create the perfect coffee

Parker and Sons Coffee Roasting in Peterborough strives to create the perfect coffee