Latest News

Yoko Ono to receive MacDowell Medal

Yoko Ono to receive MacDowell Medal

Olympic Studies is a tradition at Mountain Shadows

Olympic Studies is a tradition at Mountain Shadows

Katalina Davis dazzles in Mascenic shutout win

Katalina Davis dazzles in Mascenic shutout win

Mountain Shadows School hosts Olympic Studies Night

According to Temple Brighton, one of the co-founders of Mountain Shadows School, the school’s Olympic Studies Night was inspired by the 1984 Summer Olympics in Los Angeles. “There was so much energy around those Olympics, and all this excitement, and...

Jaffrey kicks off Earth Week with no-waste potluck and environmental speakers

There were no paper plates or plastic utensils to be seen during the Jaffrey Climate Initiative and Jaffrey Conservation Commission Earth Day kickoff potluck on Tuesday, where participants were asked to bring their own plates and utensils for a...

Sports

LOCAL SPORTS ROUNDUP: Conant girls’ tennis gets first win

The Conant girls’ tennis team picked up its first win of the season against three losses Wednesday, beating Trinity 6-3.In singles, Jess Yap, Caroline Rockhill, Riley Goddard and Emily Lewis all won their matches, while Nobley Walker and Grace Lewis...

Conant girls’ tennis continues to seek improvement

Conant girls’ tennis continues to seek improvement

Jack Kidd and Kidd Gloves make donation to Mt. Monadnock Little League

Jack Kidd and Kidd Gloves make donation to Mt. Monadnock Little League

HIGH SCHOOL SPORTS ROUNDUP: Tasha MacNeil leads the way for ConVal at Pelham Invita

HIGH SCHOOL SPORTS ROUNDUP: Tasha MacNeil leads the way for ConVal at Pelham Invita

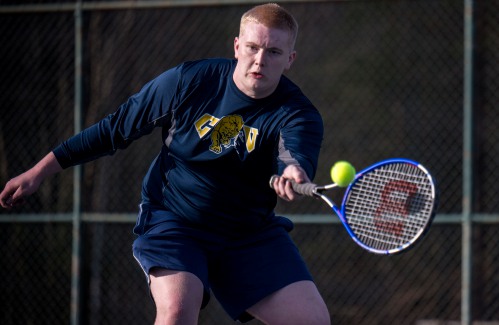

ConVal boys’ tennis looks to build experience

ConVal boys’ tennis looks to build experience

Opinion

Viewpoint: Jay Schechter – ConVal agreement no longer works

On Wednesday, April 10, the Monadnock Center For History and Culture and Monadnock Ledger-Transcript sponsored a Community Conversation. Several members of the Dublin Education Advisory Committee attended.The presentation was billed as an event to ask...

Business

Peterborough Planning Board approves 14-unit development near High Street

The Peterborough Planning Board voted 4-2 Monday to approve Ivy Vann’s and Hugh Beyer’s application for construction of a 14-unit development off High Street after a public hearing.The hearing on the subdivision application followed a site walk of the...

Deb Caplan builds a business out of her creative passion

Deb Caplan builds a business out of her creative passion

Happy Hardware looks to put the fun in hardware shopping

Happy Hardware looks to put the fun in hardware shopping

Arts & Life

Gnome Notes: Emerson Sistare – Amor Towles weaves tapestry in ‘Table for Two: Fictions’

A book review by The Toadstool Bookshop in Peterborough.“Table for Two: Fictions,” by Amor TowlesWhile some authors have name-recognition, others have “title-recognition” -- when one or more their works is so widely read that it has overshadowed its...

Jaffrey Civic Center hosting Heart of the Arts

Jaffrey Civic Center hosting Heart of the Arts

Project Shakespeare to present ‘The Miraculous Journey of Edward Tulane’

Project Shakespeare to present ‘The Miraculous Journey of Edward Tulane’

The Thing in the Spring returns May 16

The Thing in the Spring returns May 16

Project Shakespeare seeks summer students

Project Shakespeare seeks summer students

Obituaries

Kevvin W. Sawtelle 31

Kevvin W. Sawtelle 31

Kevvin W. Sawtelle, 31 Jaffrey, NH - Kevvin W. Sawtelle, 31, of Rindge, died peacefully on April 5, 2024, in the arms of his family at the Dartmouth-Hitchcock Medical Center in Lebanon, NH after a long battle with brain cancer. Kevvin w... remainder of obit for Kevvin W. Sawtelle 31

Constance Boldini

Constance Boldini

Westmoreland, NH - Constance Marie (Wilson) Boldini, died April 16, 2024. She is predeceased by her husband Guido Boldini and her son Peter Vaillancourt. She is survived by two daughters, Anne Young of Tennessee, Brenda Bryer of Stoddar... remainder of obit for Constance Boldini

Beverly R. Gienty

Beverly R. Gienty

Peterborough, NH - Beverly R. Gienty, 88, of Windsor, CT, formerly of Peterborough, Dublin, Francestown, and Jaffery NH passed away on April 14, 2024, at Kimberly Hall South, Windsor, CT. She was the widow of Edward H. Gienty. Beverly w... remainder of obit for Beverly R. Gienty

David Albin Shaw

David Albin Shaw

Peterborough NH - David A. Shaw, age 85, of Peterborough died April 7, 2024 after a long co-existence with Alzheimer's disease. He will be missed by his family, friends and devoted caregivers. His care and their love in the Memory Suppo... remainder of obit for David Albin Shaw

Molly Howard and Donovan Fenton talk issues at Hancock Town Library

Molly Howard and Donovan Fenton talk issues at Hancock Town Library

PHOTOS: Jaffrey Woman’s Club hosts Earth Day activities

PHOTOS: Jaffrey Woman’s Club hosts Earth Day activities

HOMETOWN HEROES – Rose Novotny is motivated by community

HOMETOWN HEROES – Rose Novotny is motivated by community

HOUSE AND HOME: The Old Parsonage in Antrim is a ‘happy house’

HOUSE AND HOME: The Old Parsonage in Antrim is a ‘happy house’ Former home of The Folkway in Peterborough is on the market

Former home of The Folkway in Peterborough is on the market Two Jaffrey-Rindge Destination Imagination teams move on to Globals

Two Jaffrey-Rindge Destination Imagination teams move on to Globals Parker and Sons Coffee Roasting in Peterborough strives to create the perfect coffee

Parker and Sons Coffee Roasting in Peterborough strives to create the perfect coffee

Parker and Sons Coffee Roasting in Peterborough strives to create the perfect coffee

Parker and Sons Coffee Roasting in Peterborough strives to create the perfect coffee