Business Quarterly: Dan Petrone – Is the real estate market about to crash?

| Published: 01-24-2023 9:02 AM |

What lies ahead for the real estate market in 2023? How will the economy, interest rates, and consumer behavior affect the real estate industry in the months to come? Is the market about to crash? Are we in another bubble?

There is certainly a lot of negative sentiment out there, a lack of confidence, and the masses listen to the masses.

Of course, I don’t have a crystal ball to answer these important questions. However, to make a good prediction, we must first analyze what the market has been through over the past few years. It has been two years since the start of the COVID-19 pandemic. The world was rocked by this virus and there is undoubtedly a new normal.

The remote and hybrid work options are here to stay. This has allowed many people to live in places they choose to, as opposed to having to be near an office or at a specific work location. In real estate, we call this looking “cross market.” This essentially means that the client is not limited to a certain radius for job-related purposes.

Since the recession of 2008, the market has been trying to catch up. Builders were simply not building as many homes over the last decade because there just wasn’t the demand. Fast-forward to 2020 and the government steps in to stop the economy from crashing due to COVID implications. They print more money – a lot of it! As a result, this makes the money already out there worth less. Everyone was stuck at home and saying, “Let’s get a home with more space.” “Lets upgrade.” “Let’s get a second home, get out of the densely populated areas, work from home.”

The job market was exploding and debt was cheap. The demand is now there, but we simply do not have the supply, so prices soar.

So here we are at the beginning of 2023. The market is indeed “cooling” to a point. Interest rates will continue to fluctuate, yet this does not look like a bubble and it doesn’t feel like a crash is coming. The market is not being driven by over-valuation and speculation as in the last bubble/crash. There are no “crazy” income stated loans, no doc loans, no-credit/no-problem loans, etc. In fact, getting a loan is still very difficult.

That said, lenders will indeed get more creative with their programing and adjustable-rate mortgages (ARM) will start to become more widely used again. A decline in unit sales may be evident this year and pricing may not soar as it did a year ago. However, properties may still appreciate because of supply and demand. Some even say there are millions of first-time home-buyers waiting for their opportunity to own a home.

Article continues after...

Yesterday's Most Read Articles

Deb Caplan builds a business out of her creative passion

Deb Caplan builds a business out of her creative passion

Peterborough Farmers’ Market opens for the season

Peterborough Farmers’ Market opens for the season

Scott Bakula starring in Peterborough Players’ ‘Man of La Mancha’

Scott Bakula starring in Peterborough Players’ ‘Man of La Mancha’

Young scientists show off their stuff at science fair in Francestown

Young scientists show off their stuff at science fair in Francestown

HOUSE AND HOME: The Old Parsonage in Antrim is a ‘happy house’

HOUSE AND HOME: The Old Parsonage in Antrim is a ‘happy house’

People are still migrating to the Northeast, and the Monadnock region is a unique and special place that will continue to draw people from all over the country.

It’s no surprise that New Hampshire remains one of the most-desirable states to move to in the country. This is for a myriad of reasons and not limited to no state income tax, no sales tax, clean fresh air, exceptional natural beauty, low crime, great schools, little risk of natural disaster, endless outdoor recreation options and tons of maple syrup.

Today, there are still more people needing and wanting homes in New Hampshire than are available. Much of New Hampshire has conserved land and the zoning in many areas is not conducive for density and development at the rate needed. The balancing act of maintaining growth and prosperity in communities while preserving their characteristics and desirability is a daunting task.

Add to this the soaring inflation and seemingly endless disruption of the global supply chain, and you definitely have some chaos. Unfortunately, this wasn’t created overnight, and it certainly will not change overnight.

Let’s choose to be optimistic and say there is light at the end of the tunnel. The dynamics and the environment have changed and will most likely continue to do so in 2023. Sellers and buyers alike will need to have realistic expectations. Sellers can expect more competition from other properties on the market, longer days-on-the-market and more compromise with buyers.

For buyers, the properly priced homes in desired areas may still sell quickly. It looks like we are coming back down to a new reality and not necessarily a real estate crash. Short of an “everything” crash, the housing market will seemingly remain challenging this year. To have success on either side of the coin, stay active in the market and work with a local real estate professional.

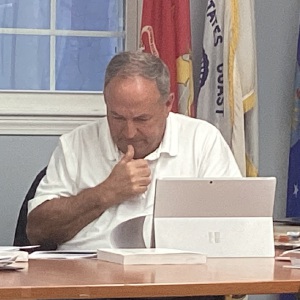

Dan Petrone is a Realtor in partnership with Bean Group in Peterborough.

Harris Center conducts veterans hike at Jack’s Pond in Hancock

Harris Center conducts veterans hike at Jack’s Pond in Hancock Old Homestead Farm in New Ipswich requests variance for short-term rental cabins

Old Homestead Farm in New Ipswich requests variance for short-term rental cabins PHOTOS: Cleaning up Memorial Park

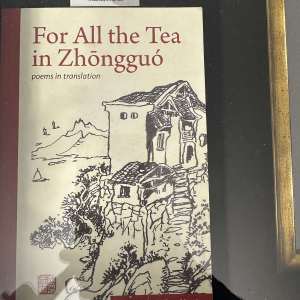

PHOTOS: Cleaning up Memorial Park Martin discusses experience in China

Martin discusses experience in China