Business Quarterly: Nisa Simila – Don’t fear the IRS

Nisa Simila COURTESY PHOTO

|

Published: 01-23-2024 9:00 AM

Modified: 01-25-2024 9:00 AM |

When you hear the word “taxes,” do you feel fear forming in the pit of your stomach? Does your heart start palpitating? Because of the way the IRS has been portrayed in the media, it’s no wonder that the IRS seems scary. However, you don’t have to be afraid, and taking time to understand your tax return is the surest way to combat the anxiety around taxes.

So, why are taxes so scary to so many people? Read on to find some common reasons why.

It’s like a big puzzle with 5,000 pieces and you have no idea where to start. You might think there is so much to know, but as our volunteer tax-preparers are told, you don’t need to know everything. You just need to know how to find information or who to ask. It takes teamwork to make the dream work. There are paid tax professionals if you think your tax return is complicated and they can help you sort out the tax puzzle pieces. The internet is full of information, but use your critical thinking skills to weed out the reputable sources of information (such as the IRS) from the sketchy ones.

Think of taxes as a fun puzzle to be solved rather than a big monster to fight.

Who likes making mistakes? No one, but you learn from those mistakes and you keep going. The IRS is not going to knock down your door and hand you a red-marked tax return and demand that you fix it ASAP. You might get a letter. The IRS may fix the mistake themselves. Most tax software these days walk you through the tax process.

Make friends with the tax software that meets your needs and relax. If your income falls in the low to moderate range, you may be eligible for free tax preparation by a program such as ours, the IRS-sponsored Volunteer Income Tax Assistance program. Your preparer can help you navigate the system so those mistakes are less scary.

When you open up your mailbox to find an IRS letter, it can strike fear in your heart. You toss it into your junk drawer, hoping it will disappear. However, most correspondence from the IRS is time-sensitive so don’t pretend it’s not there. Take a deep breath, open up the letter and find out what the IRS has to say. It might tell you that your return is missing a form. Maybe you’ve made a math error. Maybe they want you to verify your identity. You won’t know until you open that envelope and it’s rarely as bad as you think. The IRS will give you direction on what they want you to do, and what they will do.

None of us likes to find out that we owe money to the government. Some situations we see here at The River Center are when people didn’t have enough taxes withheld from their paychecks or they took out an early withdrawal from their 401(K). Instead of not paying and accruing penalty fees and interest on that debt, make a payment plan with the IRS or your account may be sent to collections. If you have low to moderate income, you can apply online or on the phone for assistance with the Low Income Taxpayer Program (603legalaid.org) here in New Hampshire. They offer services to help low-income taxpayers with federal tax controversies. You can also contact the Taxpayer Advocate Service (taxpayeradvocate.irs.gov) for help with an IRS problem that you can’t resolve yourself.

Article continues after...

Yesterday's Most Read Articles

ConVal officials propose one athletic director position

ConVal officials propose one athletic director position

Sixteen-unit development draws ire from neighbors in Jaffrey

Sixteen-unit development draws ire from neighbors in Jaffrey

UPDATE: Drivers identified in Jaffrey dump truck crash

UPDATE: Drivers identified in Jaffrey dump truck crash

Mary Lawler remembered for a life of service

Mary Lawler remembered for a life of service

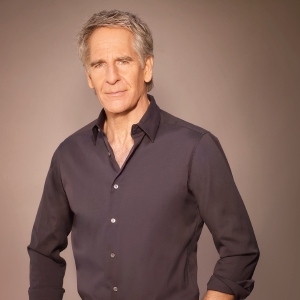

Scott Bakula starring in Peterborough Players’ ‘Man of La Mancha’

Scott Bakula starring in Peterborough Players’ ‘Man of La Mancha’

Spellers strut their stuff at inaugural Greenfield Spelling Bee

Spellers strut their stuff at inaugural Greenfield Spelling Bee

The only reason to be fearful of an audit is if you are afraid they’ll uncover something deliberately amiss in your financial affairs. Some red flags are self-employment income, math errors, claiming a hobby as a business, taking the home office deduction and more. One reason we see more often than we would like is when two people try to claim the same child as a dependent or qualifying child for the Earned Income Tax Credit or Child Tax Credit. To make this experience easier on yourself, keep documentation supporting the income, credits, or deductions you’ve reported on your return.

Organize your documentation, make sure you have included information from all forms on your tax return and visit any of the sound and well-known financial websites that offer information for you to learn more about taxes. If your income is around $64,000 or less, contact our Volunteer Income Tax Assistance program. An IRS-certified volunteer preparer will be a cheerleader, coach and mentor all wrapped up in one to make the tax process less scary and to give you more confidence in your financial affairs. They can also let you know about other services that The River Center offers that might benefit you and your household.

Call The River Center at 603-924-6800, Ext 30, to inquire about eligibility for our free tax-preparation program. You can also visit our website at rivercenternh.org/freetaxprep for more information.

Nisa Simila is the communications and money matters coordinator at The River Center. The River Center: A Family and Community Resource Center provides parent education, family support, and community connections in a welcoming environment to strengthen individuals and families in Peterborough, Jaffrey, New Ipswich and surrounding towns.

Funding comes from Monadnock United Way, New Hampshire Charitable Foundation, and the contributions of individuals, businesses and private foundations. The River Center is located at 9 Vose Farm Road, Suite 115, Peterborough. For information, call 603-924-6800 or visit rivercenternh.org.

Voters will soon make their choices

Voters will soon make their choices Grants help farmers implement systems to fight climate change

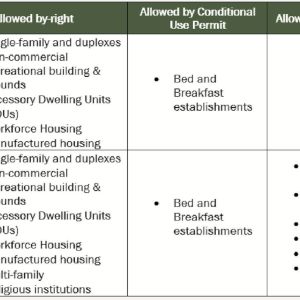

Grants help farmers implement systems to fight climate change The impact of Peterborough zoning votes

The impact of Peterborough zoning votes Jaffrey Zoning Board approves variance allowing Reality Check to move to residential area

Jaffrey Zoning Board approves variance allowing Reality Check to move to residential area