Latest News

Jaffrey Civic Center hosting ‘Two Tours’ exhibit

Jaffrey Civic Center hosting ‘Two Tours’ exhibit

Monadnock Comic Con is May 3 and 4 in Jaffrey

Monadnock Comic Con is May 3 and 4 in Jaffrey

Peterborough Players schedule ‘Curtains Up’

Peterborough Players schedule ‘Curtains Up’

Education committees gather in Dublin

Education committees gather in Dublin

Francestown Academy Coffeehouse is in its second year

Now in its second year, the Francestown Academy Coffeehouse is going strong. “We had no idea we were moving to such a supportive town. We have a good turnout every time. More and more people are becoming aware of it,” said Pamela Stohrer, who along...

UPDATE: Drivers identified in Jaffrey dump truck crash

A collision between a sedan and a dump truck on Route 202 in Jaffrey Wednesday afternoon caused a significant fuel spill across the highway and led to one driver being taken to the hospital.According to police reports, a 2023 Nissan Rogue, driven by...

Most Read

ConVal committee begins to study withdrawal process

ConVal committee begins to study withdrawal process

UPDATE: Drivers identified in Jaffrey dump truck crash

UPDATE: Drivers identified in Jaffrey dump truck crash

Francestown welcomes new Library Director Beth Crooker

Francestown welcomes new Library Director Beth Crooker

New Ipswich firefighters called on to rescue horse

New Ipswich firefighters called on to rescue horse

Big first inning carries Wilton-Lyndeborough softball to win over Sunapee

Big first inning carries Wilton-Lyndeborough softball to win over Sunapee

Temple unlikely to hold special Town Meeting on ConVal withdrawal

Temple unlikely to hold special Town Meeting on ConVal withdrawal

Editors Picks

HOUSE AND HOME: The Old Parsonage in Antrim is a ‘happy house’

HOUSE AND HOME: The Old Parsonage in Antrim is a ‘happy house’

Former home of The Folkway in Peterborough is on the market

Former home of The Folkway in Peterborough is on the market

Two Jaffrey-Rindge Destination Imagination teams move on to Globals

Two Jaffrey-Rindge Destination Imagination teams move on to Globals

Old Homestead Farm in New Ipswich requests variance for short-term rental cabins

Old Homestead Farm in New Ipswich requests variance for short-term rental cabins

Sports

Big first inning carries Wilton-Lyndeborough softball to win over Sunapee

The Wilton-Lyndeborough softball team continued its promising start Thursday with a 20-8 run-rule win over rival Sunapee that saw the Warriors jump out to a big lead in the first and then walk off in the fifth.WLC's big first inning was sparked by the...

Conant baseball shows its strength in win over Mascenic

Conant baseball shows its strength in win over Mascenic

Katalina Davis dazzles in Mascenic shutout win

Katalina Davis dazzles in Mascenic shutout win

LOCAL SPORTS ROUNDUP: Conant girls’ tennis gets first win

LOCAL SPORTS ROUNDUP: Conant girls’ tennis gets first win

Conant girls’ tennis continues to seek improvement

Conant girls’ tennis continues to seek improvement

Opinion

Letter: River Center thanks volunteers

In recognition of National Volunteer Month, The River Center acknowledges the 20 volunteers who donated over 600 hours completing training, greeting and preparing tax returns through our Volunteer Income Tax Assistance (VITA) program.Our volunteers...

Opinion: It’s time to properly fund education

Opinion: It’s time to properly fund education

Business

T & W Handyman Services in Jaffrey celebrates new location

Downtown Jaffrey welcomed a new business last week, as T&W Handyman Services moved into a new location at 10 Stratton Road.Owners Tina and Wayne St. Laurent were joined by friends, family and Team Jaffrey members to celebrate the move from their...

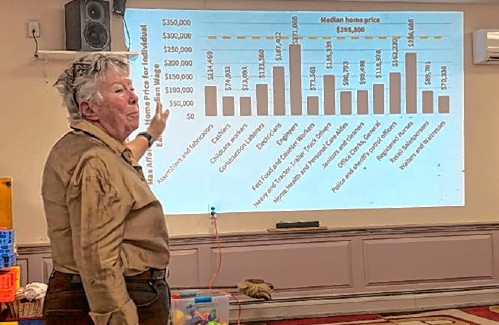

BUSINESS QUARTERLY: Grants allow towns to study housing

BUSINESS QUARTERLY: Grants allow towns to study housing

BUSINESS QUARTERLY: Dan Petrone – A guide to the commission settlement

BUSINESS QUARTERLY: Dan Petrone – A guide to the commission settlement

BUSINESS QUARTERLY – New housing projects could provide relief

BUSINESS QUARTERLY – New housing projects could provide relief

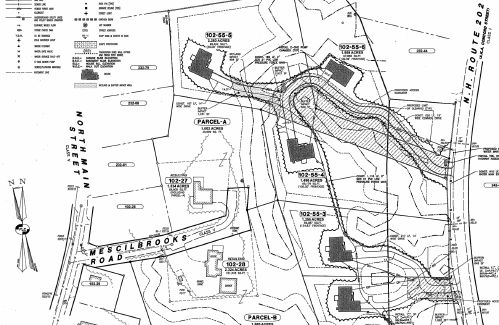

BUSINESS QUARTERLY – Antrim Planning Board approves Battaglia subdivision

BUSINESS QUARTERLY – Antrim Planning Board approves Battaglia subdivision

Arts & Life

Fassett Farm Nursery in Jaffrey focuses on native plants

Fassett Farm Nursery in Jaffrey, which has a focus on growing and selling native plants, is back for its second season starting May 4 with a new storefront, expanded hours and new consultation offerings.The nursery is owned by Aaron Abitz, and run on...

Bernie Watson of Bernie & Louise dies at 80

Bernie Watson of Bernie & Louise dies at 80

Cosy Sheridan speaks and performs for Monadnock Writers’ Group

Cosy Sheridan speaks and performs for Monadnock Writers’ Group

Obituaries

David Eddy Clinkenbeard

David Eddy Clinkenbeard

Peterborough, NH - David Eddy Clinkenbeard, 97, died on April 8th, 2024 at Rivermead, a retirement community in Peterborough, New Hampshire. He was born in Seattle, Washington on April 9, 1927, the son of Rose Eddy and Joseph B. Cli... remainder of obit for David Eddy Clinkenbeard

Mary Frances Lawler

Mary Frances Lawler

Jaffrey, NH - Mary F. Lawler, 86, passed away on April 23, 2024, at Cheshire Medical Center in Keene, NH, following a period of prolonged illness. Mary was born in Quincy, MA, on May 26, 1937, a daughter to the late Arthur T. and Ma... remainder of obit for Mary Frances Lawler

Elizabeth "Betty" G. Mahon

Elizabeth "Betty" G. Mahon

Boscawen, NH - Elizabeth "Betty" G. Mahon, age 93, passed away peacefully on Saturday, April 13, 2024 with family by her side. She was born in Salem, MA daughter of the late John and Elizabeth (Tansey) Gannon. She was predeceased by he... remainder of obit for Elizabeth "Betty" G. Mahon

Phillip A. Avery

Phillip A. Avery

Bennington NH - Phillip A Avery, 81, of Bennington, peacefully passed away on April 4,2024 after a long and hard-fought battle with cancer, while under hospice care at Monadnock Community Hospital with his wife Ann and the love of his f... remainder of obit for Phillip A. Avery

Ana Armengod showing experimental films for MacDowell Downtown

Ana Armengod showing experimental films for MacDowell Downtown

Peterborough Town Library hosting ConVal student art show

Peterborough Town Library hosting ConVal student art show